Overview

Freedom Mortgage was founded in 1990, and is now licensed to lend in all 50 states, plus D.C., Puerto Rico, and the Virgin Islands.

Freedom has a strong focus on helping military members and veterans, and is an expert in VA mortgage and VA refinance. However, Freedom isn't limited to VA loans. It also offers conventional, FHA, and USDA mortgages to appeal to a broad range of customers. This supports the company's mission statement: "It is our mission to foster homeownership for all customers across America and to embed inclusion, diversity and equality into everything we do in the process." Does this make Freedom the best mortgage lender for you? Read on to find out.Freedom Mortgage rates

The rates in the table are 2019 averages, so they don’t reflect what you’ll be offered today.

However, they can give you an idea of how competitive Freedom’s rates are compared to other major lenders.

Average 30-year fixed rates at major lenders

Freedom Mortgage |

Wells Fargo |

Quicken Loans |

Veterans United |

|

Average 30-Year Interest Rate, 2019 |

4.15% | 4.22% | 4.16% | 4.0% |

Monthly P&I Payment* |

$972 | $980 | $973 | $955 |

Median Loan Costs, 2019 |

$4,978 | $3,484 | $5,075 | $3,666 |

Median Origination Charge, 2019 |

$564 | $1,199 | $2,085 | $0 |

For context, Veterans United almost exclusively originates VA loans. And those typically come with lower rates than other types of mortgages. So its average is skewed downward by that.

Freedom also originates plenty of VA loans.

But many of its other mortgage products have higher rates, because they’re aimed at less creditworthy borrowers. So Freedom’s average mortgage rates look pretty good when you allow for that.

*Monthly principal and interest payment based on a $250,000 home price, with 20% down, at each company’s average 30-year interest rate for 2019. Your own rate and monthly payment will vary.

Verify your new rate (Aug 15th, 2020)Freedom Mortgage review for 2020

Freedom genuinely seems keen to help less advantaged homebuyers.

You can get an FHA or VA loan with a credit score as low as 600. If you want a conventional loan or a USDA loan, you’ll likely need a FICO score of 620 or higher.

Some refinances have credit score thresholds of 550. And a few don’t have any minimum at all.

This can make Freedom Mortgage a great choice for refinancing. (Remember, you don’t have to refinance with your current mortgage company. You’re free to shop around.)

Credit score flexibility

Freedom’s minimum VA loan score is slightly higher than some other lenders (580 is common).

However, the company is willing to consider “nontraditional credit histories.”

That means it will take into account how good you are at making on-time payments for rent, utility bills, and so on. Those aren’t generally included in credit reports so don’t contribute to scores.

And that means, if your case is borderline, you may stand a better chance of getting your mortgage with Freedom than with many other lenders.

Down payment assistance

Freedom also works with many down payment assistance programs.

So you may be able to get a grant or loan if your savings fall short of what you need for your down payment.

This can help conventional and FHA borrowers, who need to make a down payment of 3%-3.5%.

VA borrowers don’t need a down payment, so it’s less of an issue.

Philanthropy

It’s worth noting that Freedom Mortgage has a strong reputation for philanthropy.

It’s been especially generous to the USO, which supports military families. Indeed, its executives have been honored by a USO Chairman’s Award and The Philadelphia Inquirer for its contributions. And in June 2020 alone, it donated $1 million to Feeding America.

So if you get a great deal from Freedom Mortgage, you can also feel good about working with a company that truly gives back to communities.

Working with Freedom Mortgage

If you want an all-digital mortgage lender, Freedom might not be for you.

But if you like a more traditional, personalized approach, this lender could be just your cup of tea.

Freedom’s website is helpful in lots of ways. And you can use it to find a local loan officer.

But there’s no online application facility — nor much of the IT functionality you find on some other lenders’ sites.

Instead, Freedom focuses on phone-based or in-person conversations to help you set up your mortgage.

Getting preapproved by Freedom Mortgage

Freedom is one of those lenders that don’t give you any clue about the rate you’ll get until you’re preapproved.

This isn’t a bad thing. Too many advertise low “teaser” rates on their sites only to disappoint you later.

But getting preapproved means Freedom will run a “hard” credit check. And a hard check inevitably reduces your credit score by a small number of points (though it should quickly recover). Running a hard check is very typical with most lenders.

Fortunately, there’s an easy way to limit credit dings when shopping for a mortgage.

Just apply to all the lenders on your shortlist within a “focused” period, which is widely thought to be at least two weeks.

If you do that, credit scoring technologies will recognize that you’re shopping for rates. And it will count all your applications — no matter how many you make — as just one.

So get as many mortgage quotes as you can. But ask for them all within a couple of weeks.

Verify your new rate (Aug 15th, 2020)Freedom Mortgage customer service reviews

If Freedom has a weakness, it may be in its customer service.

That could be partly explained by its target market, a big chunk of which comprises first-time homebuyers and those with financial or credit issues. Some of those borrowers may have higher expectations going in.

But there’s no denying that Freedom was toward the bottom of the rankings in the J.D. Power’s 2019 Mortgage Satisfaction Study.

Mortgage-related complaints at major lenders

Company |

Mortgage Originations 2019 |

CFPB Complaints 2019 |

Complaints Per 1,000 Mortgages |

2019 JD Power Rating |

Freedom Mortgage |

308,884 | 104 | 0.34 | 803/1,000 |

Wells Fargo |

1,026,800 | 342 | 0.33 | 837/1,000 |

Quicken Loans |

774,900 | 187 | 0.24 | 880/1,000 |

Veterans United |

122,851 | 19 | 0.15 | 891/1,000 |

How much this bothers you will likely depend on your priorities. Many would prefer lower rates and fees to Cadillac-level service.

Meanwhile, on the plus side, it has a respectable A- ranking with the Better Business Bureau and is an accredited BBB business.

Better yet, in 2020, Freedom was named a top 10 mortgage company for customer satisfaction by SocialSurvey. So it’s clearly meeting many of its customers’ needs.

Mortgage loan products at Freedom Mortgage

Freedom Mortgage offers a broad range of mortgages and refinances, including cash-out refinances.

It can also help with streamline refinancing — known as the “VA IRRRL” for VA loans — which is a cheaper, low-doc refinance for VA loan holders.

The company’s full portfolio of purchase loans includes:

- VA loans — Freedom Mortgage specializes in VA loans, which allow zero down and 600 credit score. But they’re only for service members, veterans and related groups

- FHA loans — Start at 3.5% down payment and 600 credit score

- Conventional loans— Start at 3% down and 620 credit score

- USDA loans — Another zero-down option starting, usually, at a 640 credit score. Only for homes in rural areas and suburbs designated eligible by the US Department of Agriculture (USDA)

- Jumbo loans — Large mortgages, anything over $510,400 in most areas. At the time of writing, Freedom has suspended jumbo mortgage lending due to coronavirus. But check with the company to see if they’ve reinstated the program

Most Freedom Mortgage customers will find what they need at the top of the list.

Freedom specializes in helping veterans and service members, and VA loans are typically best for those borrowers.

However, we appreciate that Freedom offers a wider variety of mortgages who don’t qualify for a VA loan, or want a different kind because it better suits their needs.

Where can I get a mortgage with Freedom Mortgage?

NMLS ID: 2767

Freedom Mortgage is licensed to lend in all 50 states, plus Washington D.C., Puerto Rico, and the Virgin Islands.

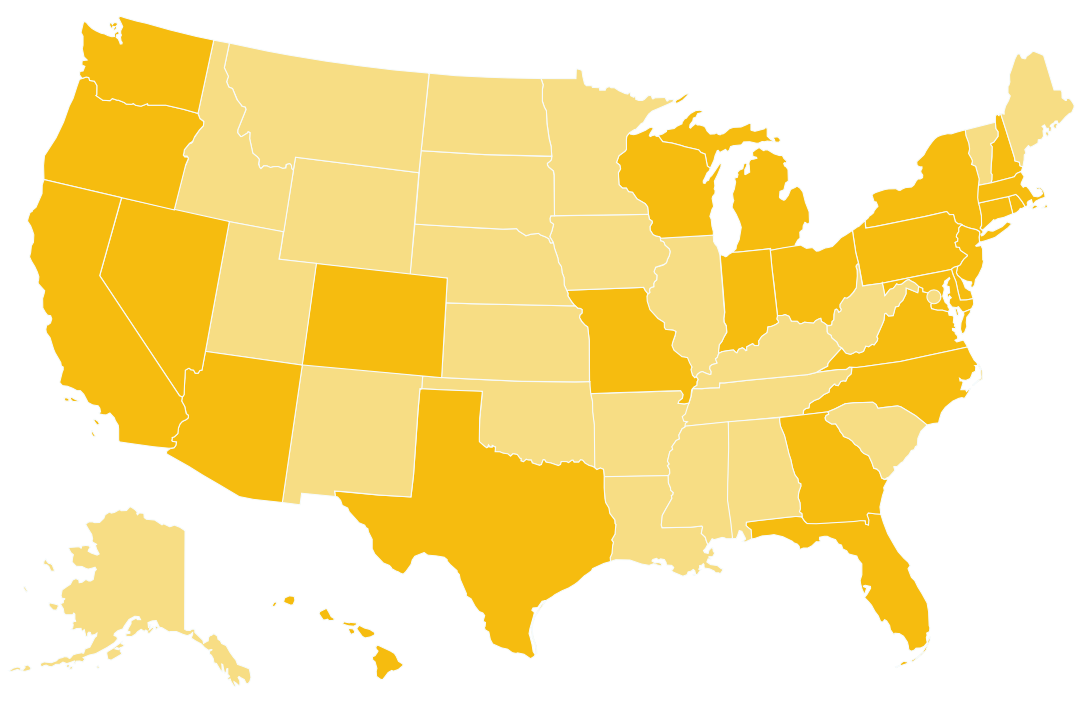

Freedom also has physical branches in 26 states: AZ, CA, CO, CT, DE, FL, GA, HI, IN, MA, MD, MI, MO, NC, NH, NJ, NV, NY, OH, OR, PA, RI, TX, VA, WA, and WI.

Freedom Mortgage is available in all 50 states. Freedom has branch locations in the states shown in dark yellow.

If you like to work with a human being when you do business, Freedom is for you. Because you’ll be working with a loan officer from the moment you apply through to closing on your home purchase or refinance.

True, the website provides some valuable information. But you can’t make an application or track progress online.

Is that a downside? It depends on how much you like working with computers.

One thing the website will allow you to do is find a loan officer who’s reasonably near you.

Just type in your ZIP code, define how close you want your loan officer to be from your address, and you could be shown details of one or more. If there isn’t one close by, you’ll be given a number to call.

Is Freedom Mortgage the best lender for you?

Freedom is a solid lender, especially for military borrowers who want to use a VA loan to buy or refinance.

Of course, you can’t ignore Freedom’s drawbacks. It’s customer service ratings could be better. And it won’t appeal to those who like the idea of an all-online experience.

But the company has a lot of strengths that many borrowers will find attractive.

In particular, it offers very competitive rates and fees to the people who need them most: those with financial or credit challenges.

If you think Freedom could be a good fit for you, check rates to see whether the company can make a competitive offer.

Verify your new rate (Aug 15th, 2020)"freedom" - Google News

August 14, 2020 at 06:54PM

https://ift.tt/2XZRWnS

Freedom Mortgage Review for 2020 | Mortgage Rates, Mortgage News and Strategy - The Mortgage Reports

"freedom" - Google News

https://ift.tt/2VUAlgg

https://ift.tt/2VYSiKW

Bagikan Berita Ini

0 Response to "Freedom Mortgage Review for 2020 | Mortgage Rates, Mortgage News and Strategy - The Mortgage Reports"

Post a Comment